What is Financial Identity Theft

By: Grace Guingon

Identity theft is a serious crime that occurs when an individual’s personal information is exploited without their consent to execute fraudulent activities and other criminal acts. Financial identity theft, in particular, has emerged as a growing concern in today’s digital age. The increasing occurrence of digital transactions and the storage of personal information online have rendered many individuals more susceptible to this kind of crime. Those that are unfortunate enough to become victims to identity theft often find themselves dealing with a range of challenging consequences.

How Does Identity Theft Occur?

Identity theft takes place when individuals unlawfully acquire the personal information of others. Common techniques for committing identity theft include phishing, rummaging through discarded documents (dumpster diving), data breaches, engaging in social engineering through phone calls and text messages, and illegally gathering data during online transactions

Forms of Financial Identity Theft:

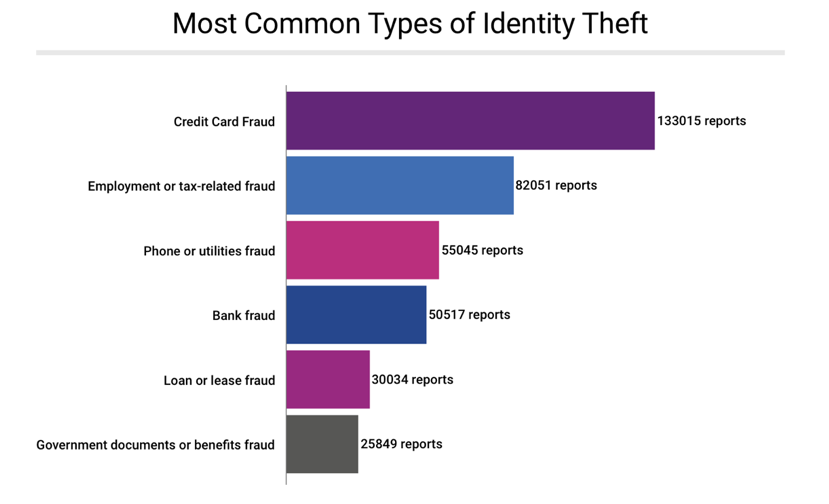

In today’s era of rapidly expanding technology, identity theft has evolved and is occurring through more sophisticated methods and avenues. Below are some of the most common methods through which identity theft takes place.

- Credit Card Fraud- This type of identity theft occurs when someone uses another individual’s credit card information without their permission. Thieves do not have to have a physical card to make authorized purchases, all they need is the pin and security code.

- Tax Fraud- Identity thieves will use another individual’s social security number to file tax returns and collect the refunds. This type is typically identified when an individual goes to file their tax return and one has already been filed for them.

- Account Takeover- This occurs when a person gains access to an individual’s bank account and makes fraudulent transactions with a person’s permission. Most thieves will transfer money from the account to their own, and often gain access to other accounts

- New Accounts- Thieves will open new financial accounts under another names. These accounts typically accumulate debt in another individual’s name leaving the victim liable for these payments.

Ways to Prevent Identity Theft

Identity theft can have distressing consequences often leaving individuals in a state of emotional distress and significant financial loss. There are proactive measures individuals can practice to shield themselves and their loved ones from these devastating experiences.

- Frequently Monitor Accounts and Credit Card Reports: Bank Account statements and credit card report should be reviewed regularly in order to detect for suspicious transaction. Unauthorized transactions are often spaced out in order to avoid detection. The sooner these are detected, the easier they will be to resolve.

- Keep Personal Information Secure: Personal Information should not be shared with others nor should it be kept in places where others have easy access to it. Individuals should avoid sharing personal information over the phone and through emails where hackers can gain access to this information.

- Create Strong Passwords: Using strong, unique passwords will make it difficult for others to gain access to accounts keeping these accounts secure. Strong passwords are usually around 16 characters long and include a complex of upper and lower case letters that are in a unique sequence, making them difficult to predict

- Shred Sensitive Documents: Documents that have any personal information for others to use should be shred before being disposed of.

- Educate Yourself: It is important to stay educated on the latest scams that individuals attempt to do, and be aware of how to prevent identity theft.

What to do if you Become a Victim to Identity Theft:

In the unfortunate event that you’ve fallen victim to identity theft, it’s important to take immediate action to minimize damage and regain control of your accounts. One of the initial steps to consider is filing a police report. This is a crucial step as credit bureaus and various organizations may require copies of these reports for documentation. It’s also important to submit a complaint to the Federal Trade Commission (FTC). Lastly, a wise course of action would be to freeze your accounts or place fraud alerts on them until the situation is fully resolved.

3 main Credit Bureaus

The three main credit bureaus in the United States are Equifax, Experian, and TransUnion. Here’s how people can obtain copies of their credit reports from these bureaus:

- Equifax

Online: Visit the Equifax website at www.equifax.com and request a copy of your credit report.

Phone: Call Equifax at 1-800-685-1111 to request your credit report.

- Experian

Online: Go to the Experian website at www.experian.com to request your credit report.

Phone: Call Experian at 1-888-397-3742 to request your credit report.

- TransUnion

Online: Visit the TransUnion website at www.transunion.com and request a copy of your credit report.

Phone: Call TransUnion at 1-800-916-8800 to request your credit report.

By law, you are entitled to one free credit report from each of these three major credit bureaus once every 12 months. You can request these reports through AnnualCreditReport.com, which is the only authorized source for free credit reports under federal law. Alternatively, you can contact each bureau individually as mentioned above. It’s a good practice to check your credit reports regularly to monitor your credit history and ensure its accuracy. Credit Bureaus have 30 days to to settle disputes once customers report fraudulent activity in order to conduct an initial investigation. The investigation can be extended up 45 days if provided with additional documentation from the customer. Once the investigation period is complete, the Bureau has 5 days to provide a written response to customers. If the bureau finds inaccuracies or fraudulent information, it must correct the errors or remove the fraudulent items from the consumer’s credit report.

Conclusion

Identity theft is a real and pervasive threat in today’s digital world. With awareness and proactive steps, you can significantly reduce your risk of becoming a victim. By protecting your personal information, practicing safe online behavior, and monitoring your financial accounts, you can safeguard your identity and minimize the potential consequences from identity theft. Stay aware, informed and take the necessary precautions to protect your identity from those who seek to exploit it for their gain.