Play the Waiting Game & Win!

By Cara Shotmeyer

Saving for major purchases can be daunting if proper planning is not implemented. Often the lure of instant gratification while shopping (in stores or virtually) catches the customer’s attention. Without proper guardrails or goals set up for future purchases, immediate frivolous spending on small ticket items will delay the opportunities to purchase larger ticket items. The age-old mantra of “spending less than you earn” is one of the best practices to act upon when saving for a big purchase.

Where do I start?

Understand your Big Picture: One common practice not to negate is reviewing your full financial picture. Although saving for major ticket items such as a car is important, it is even more important to understand the broader picture of your overall financial health. In an effort to save quickly and efficiently, other financial goals (such as paying off student loans, saving money for an emergency fund, funding a retirement account through an employer match program) may be neglected.

Set Goals: Be aware of your more immediate goals (anything less than one year), intermediate goals (between one year and five years), and your long-term goals (anything longer than five years). The timing of your savings goal will help you determine the best savings vehicle for your money such as a high yield savings account, a money market, a mutual fund, an ETF, etc). With this in mind, if you are able to be specific with your financial goals and have reasonable and attainable measures for the timeline of those goals, actions steps are able to be taken. Never underestimate the power of delaying gratification in the wake of savings.

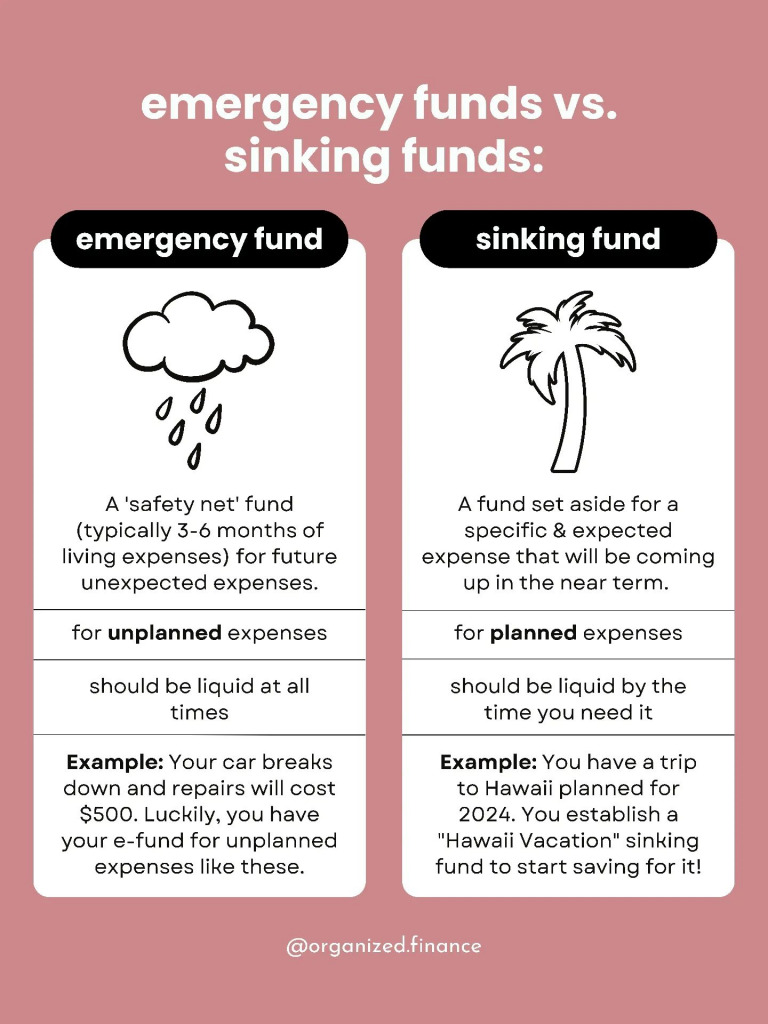

Use a Sinking Fund: Estimate how much a large ticket item costs. List out what month you need it by. Divide the cost by the number of months to determine how much money you need to save each month to purchase the item. For instance, if you are saving to purchase a used car, depending on the make and model, the used vehicle may be about $12,000. If you wanted to purchase the car two years from now, you would divide $12,000 by 24 month. This means you would need to set aside about $500/month. If that is not doable, consider waiting a longer period of time or finding a lower priced vehicle.

Determine Your Margin: Your margin in your monthly savings is a good place to start when understanding how much money you are able to save each month to put aside towards a big ticket item. Looking at your variable and fixed monthly expenses (after tax and other deductions from you gross pay), you can assess how much is left over each month to contribute to your savings. In thinking about the car purchase mentioned above, and when looking at the amount of time that it will take before having enough money to purchase this new car, consider how your variable monthly expenses could contribute to saving more monthly and in turn being able to purchase the car more quickly. These variable expenses will include but are not limited to your groceries, gas, clothing/shopping, eating out, coffee, entertainment subscriptions, gym memberships, etc. Some of the above listed items are necessary (food and gas) and other items leave room to be eliminated to further accelerate towards meeting the savings goal. Once an accurate and attainable horizon line has been established for savings towards making a major purchase, the next step is to implement your plan by starting to save periodically, which commonly is enacted through a specific amount set aside monthly or from each paycheck (generally bi-weekly).

Set Aside an Emergency Fund: Establishing at least $1,000 into an emergency fund can actually improve your saving habits. Having money saved for emergencies means that when the inevitable happens, you do not need to go into debt or utilize your sinking fund to pay for the emergency situation. You will already have money set aside to put towards the flat tire or broken window or whatever emergency you are facing. It is ideal to save 3-6 months of your living expenses in your emergency fund. If you don’t have that right now, start with building $500-$1,000.

As you think about your saving habits it may help to conceptualize that if you do not have the money today you cannot spend it today. Try visualizing your current savings physically in your wallet and having no other form of payment. This might help to encourage increased savings, so that when the money in your wallet (physically or set aside in a liquid account), can then be spent on a major purchase. Remember, current actions of delayed spending, result in future opportunities for greater spending, which is WINNING at the savings game!