Navigating the Credit Card

By Spencer Stepanian

Credit cards can be overwhelming. What do the different types of cards mean? Which card should I pick? What does the interest mean? These, among others, are some of the most common questions about credit cards. If one of these questions is yours, don’t worry we’re going to dive into each of them.

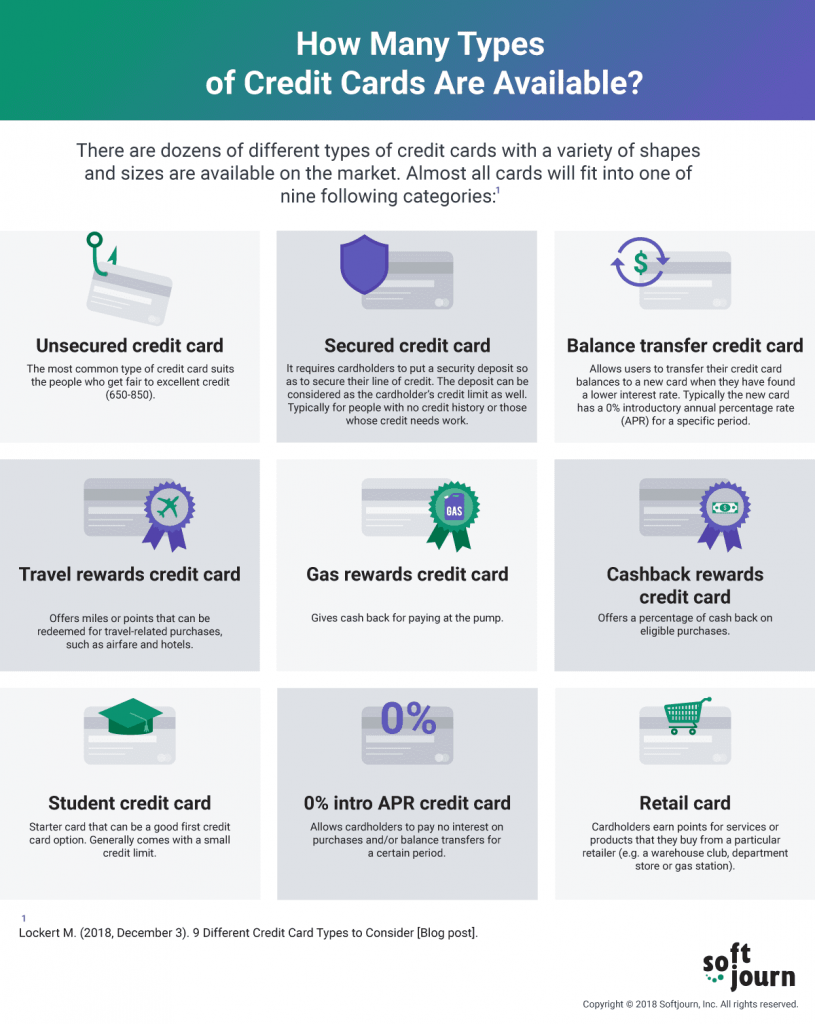

Different types of credit cards

When it comes to credit cards there are many different types, which can make choosing one quite confusing. Some of the most common types of credit cards are cash back cards, student cards, store cards, and travel cards.

- Cash back cards: these cards offer you a percentage back on the purchases you make. This can be a fixed percentage, usually somewhere between 1% and 5%; or it can vary based on the category. For example, 3% cash back on grocery stores, 2% cash back on gas, or 1% cash back on online shopping. Some credit cards structure the cash back to where you can choose which category you want to have cash back in and can change it periodically.

- Student cards: the most popular student card is the Discover card. This credit card doesn’t require a good credit score as it’s designed for students who are establishing credit. This card is only available to students and offers 5% cash back at different places which change every quarter. For example, 5% cash back on shopping at Target and Amazon, buying gas, or entertainment. The Discover student card also offers 1% cash back on all other purchases.

- Store card: store cards are offered from businesses such as Walmart, Target, Amazon, etc. These cards typically offer 5% cash back on purchases at their store and a lesser percentage on another categories, such as 2% back on dining or gas.

- Travel cards: the rewards for travel credit cards are generally miles or points used towards future purchases at the hotel, airline, etc. They can offer access into airport lounges and other travel perks. Travel cards will most likely have an annual fee that is more expensive than other types of credit cards. These cards are meant for individuals who travel frequently and are loyal to a certain airlines or hotels.

Choosing the right card

Choosing the right card can often be difficult and require a lot of thought. Not all credit cards are meant for everyone and not everyone should have a credit card. If you are someone who won’t pay the statement balance on time or won’t be able to control spending, then a credit card may not be right for you. As for choosing the right credit card, it comes down to what you’re looking for. If you don’t have a good credit score then fewer credit cards will be available to you. If you do your shopping at Target or Amazon, then a company card might be best for you. If you spend a lot of money on gas, then you might want a credit card that offers cash back at gas stations. If you’re a student and have never had a credit card, a student card might be the best fit. If you spend a lot on groceries, then a card that offers a high cash back at grocery stores. Ultimately, it’s a personal preference, and you must evaluate your spending habits and financial needs.

Credit card interest

Credit card interest is one of the scariest things when it comes to finances. The average credit card interest rate in America is 21.19%. This means that if you don’t pay your statement off in full then you will pay an average of 21.19% on top of your balance. The average credit card debt in America is $7,951, based on 2022 data from the Federal Reserve and the U.S. Census Bureau. Furthermore, America’s total credit card debt is $1.031 trillion dollars. This is the first time in America’s history where credit card debt has topped $1 trillion. Credit card debt hinders the process of building wealth, yet so many Americans are in credit card debt. If you choose to use a credit card to build your credit score, be sure to be strategic and intentional to avoid going into debt. The Bible reminds us in Romans 13:8 to “Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law”.

Conclusion

While searching for the right credit card can be daunting, it is important to remember to do your research and be cautious with what you choose. It is imperative that you pay off your credit card on time and in full, so you don’t pay interest. Credit cards are a beneficial tool if used properly, but can be detrimental if not used with caution.