Achieve Financial Freedom: The Power of SMART Goals in Financial Planning

By: Manuel Perez Inoa

Statistics and Insights

Financial planning is essential for achieving personal and financial goals. Research by Charles Schwab indicates that individuals with a written financial plan feel ten times more confident about reaching their objectives than those without one. Additionally, a Forbes study reveals that 92% of people fail to achieve their New Year’s resolutions or financial goals due to a lack of structure and actionable plans. This underscores the importance of financial planning in attaining success.

Biblical Perspective

The significance of planning is deeply rooted in biblical wisdom. In Luke 14:28, Jesus asked, “Suppose one of you wants to build a tower. Won’t you first sit down and estimate the cost?” This not only pertains to sacrifices in following Him but also serves as a metaphor for our personal aspirations.

The Reality of SMART Goals

Setting goals and planning for the future foster responsible stewardship, ensuring that resources are managed wisely. One effective method for creating impactful and actionable goals is the SMART framework, which helps in making goals specific, measurable, achievable, relevant, and time-bound.

Personal Experience

Last year, I partnered with former peer financial coach Spencer Stepanian from Liberty University, aiming to build a $3,000 emergency fund. Understanding the significance of this goal for financial security, I committed to saving $100 monthly. With discipline, I achieved my goal and now have that money in a high-yield savings account for unexpected expenses.

Creating SMART Goals

A structured plan is crucial in achieving goals, like I did. A SMART goal transforms abstract desires into concrete objectives, offering clear direction and purpose. Here’s how to create SMART goals:

1. Specific: Clearly articulate what you want, why it’s important, who’s involved, and the necessary resources. For instance, instead of saying, “Improve customer service,” specify, “Decrease waiting time.”

2. Measurable: Ensure that your goal has quantifiable indicators. For my emergency fund, I knew $1,500 represented halfway to my $3,000 target.

3. Attainable: Your goal should be realistic and achievable. For example, setting aside $100 monthly for a vacation is both challenging and attainable, fitting into a budget.

4. Relevant: Align your goals with what matters most to you, such as family or financial security. A student might focus on paying off loans to gain freedom for future giving. Ask yourself, what matters most to me?

5. Time-bound: Establish a deadline to create urgency and promote disciplined behavior. My deadline for the emergency fund was to reach $3,000 as soon as possible.

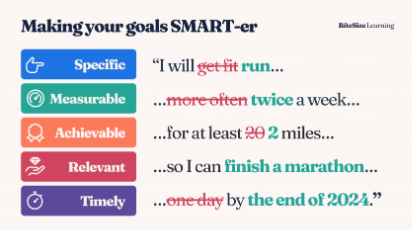

Here’s a brief illustration of transforming a common goal into a SMART goal:

– Before: “I will save to go on vacation next year.”

– After: “I will save $100 monthly to go on vacation next summer.”

Here is another common goal turned into a SMART goal:

Final Thoughts

Identify something significant to you, whether it’s a destination, item, or experience. If it’s meaningful, create a SMART goal to help achieve it more efficiently. As Philippians 4:13 states, “I can do all things through him who gives me strength.” This mindset can empower you to realize your ambitions.

Links:

https://www.aboutschwab.com/modern-wealth-survey-2021 (2020 Schwab Modern Wealth Survey)

https://www.forbes.com/sites/ashiraprossack1/2018/12/31/goals-not-resolutions/ (Forbes Financial Goal Setting)

https://www.biblegateway.com/versions/New-International-Version-NIV-Bible/ (New International Version Bible)

https://www.bitesizelearning.co.uk/resources/smart-goals-meaning-examples (BiteSize Learning)