You vs. The Federal Reserve

By Holden Foster

Introduction:

The Federal Reserve serves as the central bank of the United States, responsible for regulating financial markets and setting interest rates. While its importance may not be immediately evident, the Federal Reserve has a profound influence on your life, particularly if you carry student loans. In fact, its impact outweighs that of Instagram, McDonald’s, and even Michael Jordan. Through its regulation of financial markets and the use of tools like the “discount rate,” the Federal Reserve indirectly affects the amount of cash you have in your wallet.

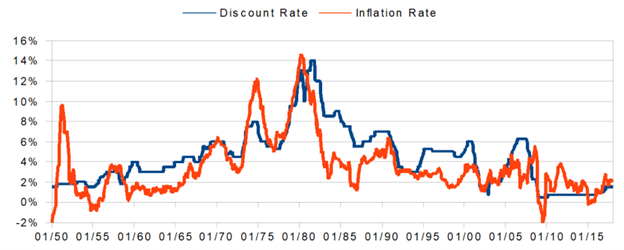

Exploring the Discount Rate and Inflation:

The “discount rate,” helps combat inflation—an economic term we have frequently heard in recent years. Although the discount rate itself does not directly control inflation, it serves as a valuable tool in managing it. Historical data from 1950 to 2015 reveals a notable correlation between an increase in the discount rate and a subsequent decrease in inflation levels.

Impact on Interest Rates and Loans:

By adjusting interest rates, the Federal Reserve affects the money supply and the cost of borrowing. The discount rate represents the interest rate at which the Federal Reserve lends to banks such as Wells Fargo and Bank of America. When the discount rate rises, banks are compelled to lend money at higher rates. Consequently, average consumers bear the brunt through increased interest payments on various loans, including business loans, mortgages, and federal student loans.

A Hypothetical Scenario:

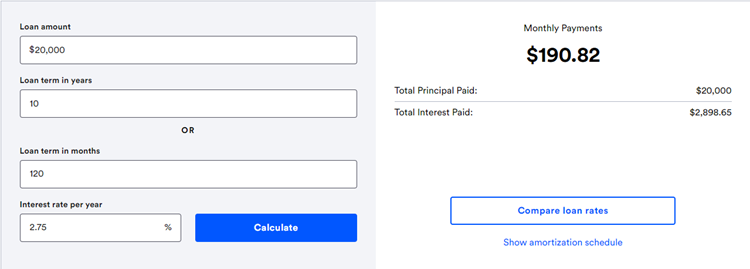

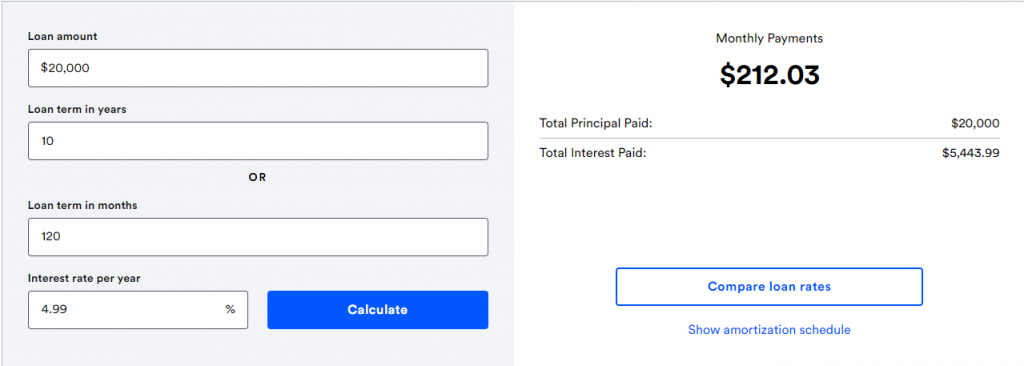

Consider a hypothetical scenario involving Bob, who took out a $20,000 student loan for the 2020-2021 school year when the inflation rate was a mere 1.4%. Due to the low discount rate at that time, Bob only paid 2.75% interest on his federal student loan. However, had Bob taken out the same loan for the 2022-2023 school year, characterized by a higher inflation rate of 7%, his interest rate would have been 4.99%. This seemingly slight increase in interest could have cost Bob over $2,500 more over a ten-year loan term.

2020-2021 Loan

2022-2023 Loan

Anticipating Changes in Student Loan Rates:

Government student lending rates are recalibrated annually on July 1st, based on economic conditions. Since May 2022, the Federal Reserve has raised the discount rate from 1% to 5.75%. This significant increase suggests a potential spike in the cost of student lending for the upcoming 2023-2024 school year. Both lenders and borrowers should remain vigilant about the federal student loan rate and prepare for potential financial implications.

Maintaining a Balanced Perspective:

While financial planning and prudence are essential, excessive worrying about the future is unnecessary. Matthew 6:34 wisely advises, “Therefore do not be anxious about tomorrow, for tomorrow will be anxious for itself. Sufficient for the day is its own trouble.” This verse serves as a reminder not to overly concern ourselves with the future. Although the prospect of increased educational expenses may be unsettling, we should find solace in the belief that the Lord is Jehovah Jireh, our provider. Additionally, Jesus encouraged us not to worry about the future, as stated in Matthew 6:28, “And why do you worry about clothes? See how the flowers of the field grow. They do not labor or spin. Yet I tell you that not even Solomon in all his splendor was dressed like one of these.” While it is crucial to exercise prudence and plan diligently, we can find peace of mind knowing that God will take care of us.